Corporation Tax, National Insurance Contributions, Payroll, Personal Tax, Regulatory

Budget 2025: Your Essential Guide to the Latest Tax Changes

Who had “budget leaked early” in the sweepstakes? Joking aside, that was probably the biggest news on the day, especially given all the negative headlines in the previous weeks. Given the financial position of the country, it was always going to be a question of how the government could increase income. For context, the UK governme...

Read moreBookkeeping, Corporation Tax, National Insurance Contributions, Payroll

How to Change Accountant: A Stress-Free Guide for Business Owners

Switching accountants might seem daunting, but you don't need to wait until year-end to make the change. Your business or limited company can transition to WCL smoothly with minimal disruption. The switch makes sense when your current accountant fails to provide proactive advice or overlooks potential savings. The process works seamles...

Read moreAllowances, Bookkeeping, Company Law, Employment Law, National Insurance Contributions, Payroll, Regulatory

UK Employment Rights Bill Sets New Rules for Businesses

The Employment Rights Bill (the Bill), published back in October 2024, brings one of the biggest changes to UK employment law in recent years with 28 reforms in multiple areas and is very near the end of its Parliamentary journey. Those in the “know”, suggest the Bill will receive Royal Assent in November 2025 with the first provisi...

Read moreCompany Law, Contracts, Corporation Tax, Employment Law, National Insurance Contributions, Payroll, Regulatory

Contractor vs Employee: The Truth About Hiring Costs in 2025

The contractor vs employee decision can save your business thousands of pounds if you understand the true cost implications. The UK has 2.05 million freelancers in 2024, and businesses are thinking over their hiring options more than ever. Contractors might charge higher hourly rates than employees, but the complete financial picture isn'...

Read moreBookkeeping, Company Law, Corporation Tax, National Insurance Contributions, Personal Tax, Regulatory

Changing from Sole Trader to Limited Company: Your Step-by-Step Blueprint

Are you running a sole trader business that's making £50,000 yearly profits? At the time your earnings hit this threshold, switching from sole trader to limited company status becomes a smart financial choice. Your growing business might make you think about changing to a limited company structure to save on taxes. In fact, the switch...

Read moreBookkeeping, Corporation Tax, National Insurance Contributions, Software

How to Read a Balance Sheet: A Plain-English Guide for UK Business Owners

Reading your balance sheet isn't just good practice - it's crucial for any business owner. Your balance sheet shows what your business owns (assets) and owes (liabilities) at any given moment. This financial statement ranks among the most important documents that business leaders, regulators, and potential investors need to understand. ...

Read moreDifferent Share Classes Made Simple: A Practical Guide for Company Directors

Most new companies begin with a single class of 'ordinary' shares. These shares give equal voting and dividend rights to all shareholders. The standard approach however might not meet your business needs as your company expands. Your company faces no strict limits on the number of share classes it can have. Different share classes offe...

Read moreCompany Law, Employment Law, Payroll, Regulatory

Statutory Payments – Neonatal Care Leave

Welcome to the third and final instalment of our statutory pay series. In part one we covered what statutory pay is, the minimum earning thresholds, and amounts etc. In part two we went through how to set up your payroll system and common pitfalls to avoid. And now, in this final part we will discuss some of the key points in handling req...

Read moreCompany Law, Contracts, Regulatory

How to Draft a Shareholders Agreement That Actually Protects Your Business

A shareholder’s agreement is not legally required for your business but running your business without one can get pricey with disputes that you could easily prevent. Private equity firms and institutional investors almost always need a shareholder agreement before they invest. The benefits go way beyond the reach and influence of jus...

Read moreAllowances, Bookkeeping, Corporation Tax, Employment Law, National Insurance Contributions, Payroll, Personal Tax, Regulatory

2025/2026 Tax Rates and Allowances

The tax year runs from 6 April. Here’s an overview of the main tax rates, allowances and national Insurance contributions that you need to be aware of for the tax year starting 6 April 2025. If you have any questions, would like to understand what rates specifically apply to yourself, or what allowances are available, please get in t...

Read moreAllowances, Bookkeeping, Company Law, Corporation Tax, Employment Law, National Insurance Contributions, Payroll, Personal Tax, Regulatory

Spring Statement 2025

On Wednesday 26th March 2025, Chancellor Rachel Reeves delivered her Spring Statement. In terms of announcements for the average person, it was fairly low key with many of the announcements more aimed at a national level in terms of defence spending, overseas aid, etc. That said, there were of course still announcements to be aware of. An...

Read moreBookkeeping, Company Law, Employment Law, National Insurance Contributions, Payroll, Regulatory

Statutory Payments Explained: Part Two

Welcome to part two of our three part series covering everything related to Statutory payments. In part one we went through what statutory payments are, the minimum earnings thresholds to receive them, the amount you can receive, etc. In this blog we will cover want you need to implement through your payroll systems and common pitfalls...

Read moreBookkeeping, Company Law, Employment Law, National Insurance Contributions, Payroll, Regulatory

Statutory Payments Explained: Part One

Statutory payments form the backbone of employee compensation in the UK, yet many businesses struggle to navigate these mandatory financial obligations correctly. In fact, recent HMRC data shows that thousands of companies face penalties each year for mishandling these essential payments. Understanding statutory payments is crucial for...

Read moreAllowances, Company Law, Employment Law, National Insurance Contributions, Payroll, Regulatory

Payrolling of Benefits: Your Guide to the New HMRC Rules

HMRC plans to reshape the scene of payrolling benefits with new mandatory reporting rules from April 2026. These changes will impact all employers and replace the current P11D system that processes about 4 million forms each year. Currently, P11D forms are submitted by employers by 6 July after the tax year ends. Under the proposed new...

Read moreAllowances, Company Law, Employment Law, National Insurance Contributions, Payroll, Personal Tax, Regulatory

Changes from 6th April 2025

As we approach the start of a new tax year, there are several changes coming into play that you may not be aware of. In this article we breakdown the main changes. Changes in Employers National Insurance Contributions/Employment Allowance If you’re an employer with a National Insurance Contributions (NICs) liability, or with employees...

Read moreBookkeeping, Company Law, Contracts, Regulatory, Software

The Art of Invoicing

Late payments affect nearly half of all UK invoices, creating major cash flow challenges for businesses. This sobering reality expresses why knowing how to handle invoice management is vital to your company's financial health and sustainability. Becoming skilled at invoice management requires more than asking for payments. UK businesse...

Read moreAllowances, Bookkeeping, Employment Law, National Insurance Contributions, Payroll, Software

How to Master Payroll Basics: A Step-by-Step Guide

The concept of payroll is simple, but if not done correctly can lead to big and expensive problems. It can damage business reputation and employee trust. Your business could face serious issues from missed deadlines to calculation errors when you handle payroll without knowing the simple fundamentals. So, what exactly is involved in a ...

Read moreAllowances, Company Law, Employment Law, National Insurance Contributions, Payroll, Personal Tax, Regulatory

National Minimum Wage vs Living Wage: Key Differences Explained

You’re probably familiar with the terms minimum wage and living wage. But do you know what the differences are between them? In this article we run through all the differences and what you might need to be aware of. Understanding the Three Wage Types The UK has three different wage types that everyone should know about: the Nationa...

Read moreHow to Reduce Corporation Tax: Practical Steps for Businesses

Navigating the financial landscape of corporation tax can often feel like an intricate chess game, where understanding the rules and implementing strategic moves can significantly benefit your business's bottom line. Learning how to reduce corporation tax is not just beneficial; it's essential. The importance of this endeavor lies not onl...

Read moreBookkeeping, Company Law, Regulatory, Software

HMRC e-Invoicing

In the Autumn Budget Statement, Chancellor Rachel Reeves announced an exciting development that could have a huge impact on the way businesses handle invoicing. As part of a broader package of reforms, HMRC will be launching a consultation on the implementation of mandatory electronic invoicing (e-Invoicing) across UK businesses and gover...

Read moreAllowances, Bookkeeping, Company Law, Corporation Tax, Employment Law, National Insurance Contributions, Payroll, Personal Tax, Regulatory

Autumn Budget 2024

This week new Chancellor Rachel Reeves announced both her first Budget & also the first of the new Labour government. On that note, it feels like almost every time we write about the Budget Statement in recent times we have to make reference to a new Chancellor. With the Labour Party only recently elected, hopefully this time we may g...

Read moreEmployment Law, National Insurance Contributions, Payroll, Regulatory

When to Take the Leap and Hire Your First Employee

As a business owner, if you haven’t already, it’s likely you’ll reach a point where you're feeling overwhelmed by the workload and considering bringing someone on board. The decision to hire your first employee is a significant milestone that can have a profound impact on your company's growth and success. It's a step that requires ...

Read moreHow to Launch Your Career as a Contractor

Are you ready to take charge of your career and become your own boss? Launching your journey as a contractor can open up exciting opportunities and give you more control over your professional life. As the gig economy continues to grow, more professionals are exploring the world of contracting to enjoy greater flexibility and potentially ...

Read moreAllowances, Employment Law, National Insurance Contributions, Payroll, Personal Tax

Understanding Marriage Tax Allowance: A Complete Guide

Are you curious about the tax benefits of marriage? The marriage tax allowance is a valuable opportunity that many couples overlook. This helpful provision allows married couples and civil partners to transfer a portion of their Personal Allowance to their spouse, potentially saving hundreds of pounds each year on their tax returns. Un...

Read moreAllowances, Bookkeeping, Company Law, Corporation Tax, Regulatory

HMRC Christmas Party Exemption: What Your Company Needs to Know

It may only be September, but supermarkets already have mince pies on sale. As far as we’re concerned, that means it’s ok to mention the “C” word. On that note, a common question we get asked about the holiday season is around HMRC rules on the Christmas party exemption and how it affects your company's festive celebrations. Un...

Read moreBookkeeping, Company Law, Regulatory, Software

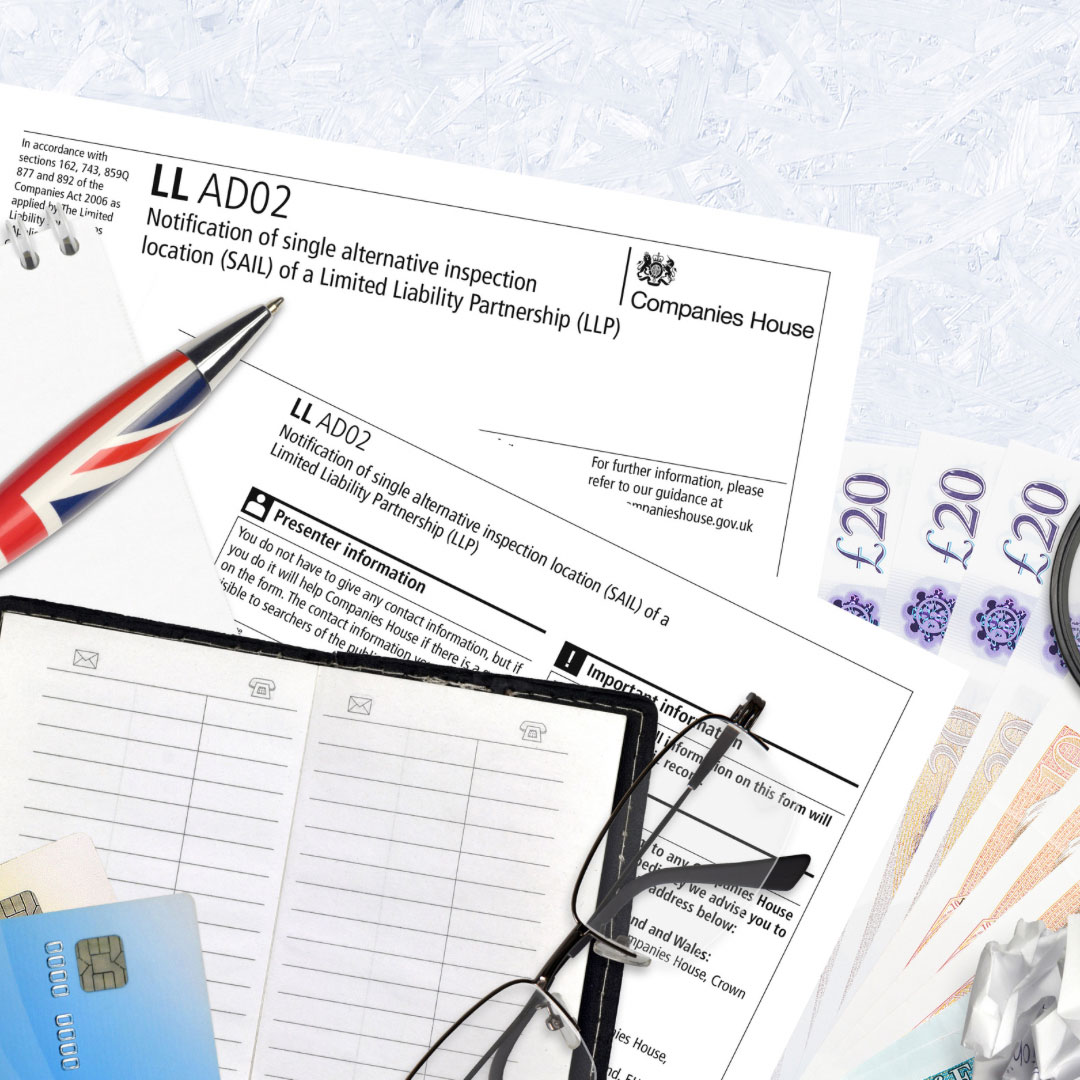

Companies House Updates

We wrote previously about planned reforms happening to Companies House, in particular covering new powers and practices. You can read the blog here: https://whittockconsulting.co.uk/changes-to-companies-house/ Following on from these proposals, we can now confirm the following have been implemented: Additional powers Companies Hou...

Read more10 Reasons to use a part-time Finance Director

There’s been a lot of talk recently about the benefits of utilising part-time Finance Directors. But what do they do? And how can they help you? In this blog we cover the main benefits of using a part-time Finance Director, how to find one and what to look for. Let’s get started… Reasons to use a part-time Finance Director ...

Read moreAllowances, Corporation Tax, National Insurance Contributions, Personal Tax, Regulatory

A Labour Promise

As far as General Elections go, the indications as to which party would succeed was fairly obvious from the off. The polls predicted a Labour win early on, and very little changed throughout. And so, after 14 years in charge, the Conservatives are out and now it’s over to Keir Starmer and Labour to get the Country back on track. S...

Read moreBookkeeping, Company Law, Regulatory

Understanding the Dynamics: Creditor vs Debtor

In the world of business and finance, the concept of creditor and debtor is fundamental to understanding how financial transactions occur. Whether personally or in terms of your business, chances are you have encountered these terms in your financial dealings. This blog aims to provide a comprehensive understanding of the dynamics between...

Read moreBookkeeping, Company Law, Regulatory

Becoming Your Own Boss

The allure of trading predictable office hours for the freedom to call the shots is irresistible to many; the path to becoming your own boss is as challenging as it is rewarding. Imagine the empowerment of flexible schedules, the autonomy over earnings, and the independence in decision-making—all attainable hallmarks when you take the r...

Read moreBookkeeping, Company Law, Regulatory

Understanding Your Director’s Loan Account

Understanding and managing your director's loan account effectively is essential if you're navigating the financials of a limited company. It's a crucial ledger that records all transactions between you and your business, ensuring clarity in the flow of funds. This blog aims to guide you through the process, from the basics of director...

Read moreCompany Director vs Company Secretary

Understanding the distinct roles of a company director and a company secretary is crucial for anyone navigating the complexities of corporate governance. While a company director focuses on managing daily business activities and ensuring legal compliance, the responsibilities of a company secretary include assisting directors, advising on...

Read moreBookkeeping, Corporation Tax, Regulatory, Software

Understanding the Difference: Turnover vs Profit

When it comes to evaluating the financial performance of your business, there are several key terms that need to be understood. Among these terms, turnover, gross profit, and net profit are fundamental concepts that provide insights into the health and profitability of a company. In this blog, we will delve into the definitions and calcul...

Read moreAllowances, Company Law, Corporation Tax, Employment Law, National Insurance Contributions, Payroll, Regulatory

Spring Budget 2024

This week Chancellor Jeremy Hunt delivered his Spring Budget. With a General Election on the horizon, many questioned how the Chancellor would balance sensible fiscal decisions with voter-pleasing political plays. Talk beforehand largely centred on further national insurance cuts and also reductions in inheritance tax. There was also t...

Read moreUnderstanding the Importance of Cash Flow Management

Understanding the nuts and bolts of cash flow management could mean the difference between a flourishing enterprise and a floundering business. At its core, cash flow reflects the heartbeat of your company, revealing the money coming in and flowing out—a true measure of financial health and liquidity. With positive cash flow indicating ...

Read moreUnderstanding the Differences: Accountant vs Financial Advisor vs Mortgage Broker

In the complex world of finance, it's easy to feel overwhelmed by the different roles that professionals play. It can be confusing to understand what each professional does and how they can help you. In this blog, we're going to break down the roles, highlighting their similarities, differences, and how each can support your needs. Under...

Read moreBookkeeping, Regulatory, Software

Why Management Accounts are a key tool for Business Growth and Success

As a business owner, you may have heard of management accounts and wondered what they are and why they are important. In this blog, we explain what management accounts are, why they are essential for business growth and success, the benefits of management accounts, the key components of management accounts, how to use management accounts ...

Read moreAllowances, Personal Tax, Regulatory

HMRC is Cracking Down on Side Hustles

There’s been a bit of a commotion recently from people who sell their old clothes on sites such as Vinted and Ebay. The reason being that it was recently announced that with effect from 1st January this year that these online platforms would need to start passing information about you onto HM Revenue & Customs (HMRC). Many have v...

Read moreCompany Law, Employment Law, Regulatory

Protection from Redundancy

From 6 April 2024, employees who are pregnant or returning from maternity, adoption or shared parental leave will gain priority status for redeployment opportunities in a redundancy situation. Under the current law, employees on maternity leave, shared parental leave or adoption leave already have special protection in a redundancy sit...

Read moreAllowances, Employment Law, Payroll, Personal Tax, Regulatory

Claiming Expenses For Working From Home

Working from home has become a new norm for many UK businesses. With this shift, the concept of 'business use of home' has become more prevalent and crucial. It refers to the expenses you incur by using your home as a workplace. These expenses can be claimed as tax deductions, reducing your overall taxable income. But, understanding what ...

Read moreCompany Law, Regulatory, Software

Changes to Companies House

It’s not often that rules and regulations relating to Companies House change. However, we’re about to experience multiple changes, starting in 2024. The reason being that the Economic Crime and Corporate Transparency Act 2023 (ECCTA) received Royal Assent on 26 October 2023. The ECCTA is a key part of the Government's ongoing legislat...

Read moreNational Insurance Contributions, Payroll, Regulatory

National Insurance Contributions Cut

On 22 November the Chancellor presented his latest Autumn Statement. You can read our summary here. Within the Statement he announced that National Insurance Contributions (NICs) would be either reduced or cut altogether (depending on the type of contribution class). You can see an overview of the changes below. As well as being awa...

Read moreWhat happens if my tax return is submitted late?

The process of tax filing in the UK is fairly straightforward but requires a thorough understanding of the various tax codes, allowances, and deductions. Typically, tax returns have to be filed by the 31st of January following the end of the tax year, which runs from 6th April to 5th April the next year. Despite this, there are instanc...

Read moreAllowances, Company Law, Corporation Tax, Employment Law, National Insurance Contributions, Payroll, Personal Tax, Regulatory

Autumn Statement 2023

This week the Chancellor presented his Autumn Statement. This was an eagerly anticipated Statement, as we waited to see if he would act based on the recent positive financial results (lower inflation, improved GDP predictions, etc), or whether he would take a more cautious approach. The Chancellor answered that question during his init...

Read moreAllowances, Company Law, Corporation Tax, National Insurance Contributions, Regulatory

Navigating Property Investment: Sole Trader Vs Limited Company

The world of property investment is indeed a fascinating one. It offers numerous opportunities for investors to potentially grow their wealth, while also providing a tangible asset that can be beneficial for long-term investment. In the UK, property investment has always been a popular choice among investors due to the stability of the ma...

Read moreCompany Law, Contracts, Regulatory

Choosing the Right Path: Best Legal Structures for a Joint Venture

The term 'joint venture' has become quite prevalent in the business world today. But what is a joint venture? A joint venture is an arrangement where two or more parties agree to pool their resources for the purpose of accomplishing a specific task. This task can be a new project or any other business activity. In a joint venture, each pa...

Read moreAccounts Assistant Opportunity

Due to expansion plans we have an exciting opportunity for an additional Accounts Assistant to join the team. About Us We’re a rapidly growing accountancy practice based in North East Bristol, whose client portfolio comprises growing SMEs across the country ranging from start-ups to much larger groups of companies. We ...

Read moreCompany Law, Employment Law, Regulatory

Getting clear on protecting data (guest blog)

Do you understand what is required of you when it comes to holding and using personal data? Do you know what happens if you breach those requirements? To help you understand the importance of protecting data, and why it matters, Chris Burn, data protection specialist at CSRB has kindly written a guest blog for us: Introduction P...

Read moreBookkeeping, Company Law, Corporation Tax, Employment Law, National Insurance Contributions, Payroll, Personal Tax, Regulatory, Software

Expanding Our Services

At WCL we’re always looking for ways to better serve our clients, whether this be improvements to our current services, or offering additional services. To allow us to identify where we can improve or what additional support is required, the best source of information is feedback from our clients. And based on feedback we’re excite...

Read moreAllowances, Company Law, Corporation Tax, Employment Law, National Insurance Contributions, Payroll, Personal Tax, Regulatory

Spring Budget 2023

This week Chancellor Jeremy Hunt presented his Spring Budget Statement. In the lead up to the Budget, many experts were predicting what was supposed to be a relatively ‘dull’ Budget, with few surprises expected. And whilst it was a fairly basic Budget in terms of the number of announcements, the announcements were anything but dull. ...

Read moreAllowances, Bookkeeping, Company Law, Corporation Tax, Regulatory

Super Deduction Tax Relief

As we count down to the Spring Statement, we’re also reminded of the upcoming deadline of a benefit introduced back in the 2021 Budget by then Chancellor, Rishi Sunak. Following two years of economic slowdown, one of the measures brought in by Rishi Sunak to help kickstart the economy post-Covid, was what is known as the Super Deduct...

Read moreClient In Focus: Commercial Property Advisors

Welcome to ‘Client In Focus’, where we introduce you to one of our many wonderful clients. If you would like to be featured, please get in touch. In todays article we would like to introduce you to Ben Sayer of Commercial Property Advisors. What does your business do? We provide a business rates review service on a risk free ...

Read moreInvolving your children in your business

Have you ever wondered about succession planning or involving your children in your business? We often get asked what options are available when it comes to adding children as shareholders, employees or both. In this blog we’ll cover the various scenarios. Why involve your children in the business? Having worked hard to build up a...

Read moreJanuary: here to stay?

If you’ve been following our blogs and newsletters, you will have noticed we’ve mentioned Making Tax Digital (MTD) once or twice. The reason being that MTD represents a significant change to the way self assessments will be submitted/managed. Thus it’s not something that can or should be ignored. As a reminder, MTD is the new sel...

Read moreAutumn Statement 2022

On Thursday 17 November Chancellor Jeremy Hunt announced his first Autumn Statement since being called to the position of Chancellor. This was never going to be a Statement of exciting promises. Rather, it was more a case of damage limitation. Unfortunately the Statement delivered what many predicted – higher taxes and spending cuts....

Read moreMeet Payroll and Pensions Administrator, Amanda Bailey

What do you do at Whittock Consulting Ltd? I look after payroll and pensions end to end. I set up new employers PAYE scheme with HMRC, set up new pension schemes, organise declarations with the Pension Regulator, manage auto enrolment, reassessing staff, keeping up to date with legislation and new procedures. All in all, quite a varied...

Read moreBouncing Bounce Back Loans

In 2020, against the backdrop of a global pandemic, as a measure to help businesses who were struggling, the British government launched a solution known as the ‘bounce back loan scheme’. The idea was that businesses would be able to easily raise finance, at a low rate of interest in order to help with their recovery. The problem i...

Read moreReversing the budget

Anybody for a round of Hokey-cokey? It's hard to keep up with Downing Street right now. Kwasi Kwarteng's "mini budget" turned out to be anything but “mini” in terms of the repercussions. As a result, he was swiftly removed from position, and Jeremy Hunt installed in his place. And as the new Chancellor, Jeremy Hunt was certainly not s...

Read moreThe Mini Budget

A month ago we discussed the campaigns and proposals of Liz Truss and Rishi Sunak as they went head to head to vie for the position of Prime Minister. You can read the blog here. Now, as we know, on 5 September, Liz Truss was announced victorious, being confirmed the UK’s new Prime Minister. Her victory was built very much on her pro...

Read moreElectric cars on the charge!

It’s no secret that the world of petrol and diesel powered cars is coming to an end. And to help speed up the transition, the government have been offering various incentives to encourage limited companies to switch over to electric vehicles. But with so many different ways of purchasing a vehicle, it can be quite confusing as to wha...

Read moreThe countdown to be the next Prime Minister – and what it means for you

After the past few years it’s hard to imagine a time where politics haven’t formed such a prevalent part of our daily discussions. Whether it’s been Brexit, lockdowns, or recessions, there seems to have been no shortage in political headlines. And over the next couple of weeks it’s only likely to intensify as the campaign to be...

Read moreMeet Accounts Assistant, Jed Hughes

What do you do at Whittock Consulting Ltd? My role is quite varied and includes amongst other things: Bookkeeping on a weekly/monthly/quarterly basis Preparation of monthly payrolls including pension submissions Preparation of monthly CIS submissions Preparation of management accounts for board meetings Assisting with ...

Read moreMeet Client Manager, Claire Smyth

What do you do at Whittock Consulting Ltd? I’m involved in a variety of different activities including: Preparation of management accounts for board meetings Preparation of statutory accounts and CT returns Preparation of self assessment returns Overseeing self assessment process and ensuring all the returns are filed o...

Read more5 Benefits of Making Tax Digital

Making Tax Digital (MTD) is the HMRC plan to switch tax administration from paper-based systems to a digital tax platform. Getting ready for Making Tax Digital (MTD) can seem like an effort, but the good news is that it will almost certainly make life easier. The aim of MTD is to help individuals and businesses manage their accounts m...

Read moreMeet Senior Accounts Assistant, Gemma Bayly

What do you do at Whittock Consulting Ltd? My role is quite varied and includes supporting clients with their bookkeeping, either completing the book keeping myself or helping clients on Xero when they get stuck. I help with year end accounts and CT600 preparation. I support Brad with management accounts and cashflow preparations. I...

Read moreMaking Tax Digital for Income Tax Self-Assessment

What is MTD for ITSA? Making Tax Digital for Income Tax Self-Assessment (MTD for ITSA) is due to launch in 2024, but you need to start preparing now. To help you, we’ll be releasing a series of articles to explain everything you need to do to get ahead of the curve and ensure a smooth, stress-free transition. From the basics, ...

Read moreChecking Your Xero Set-Up

Xero is about as reliable as you can get if you’re looking for ease, efficiency, and accuracy for your accounts. But like any smooth-running machine, from time to time it benefits from a thorough health check to make sure its systems, and yours, are operating at their best. The benefits of running a Xero health check: Update inf...

Read moreHow to get ready for Making Tax Digital for VAT

If you’re a business registered for VAT with a turnover of under £85,000, you need to know about Making Tax Digital for VAT (MTD). Your deadline is April 2022, so now is the time to sign up, do your research, and choose the right software. What is Making Tax Digital for VAT? The aim of MTD for VAT is to make it easier for busin...

Read moreGovernment announces pay rise for millions of people

Millions of UK workers are to receive an increase in pay from April 2022 following rise in the National Minimum Wage. The Government have announced the rise in the National Minimum Wage and National Living Wage from April 2022. In full, the increases are: National Living Wage (23+) to increase from £8.91 to £9.50 National Mi...

Read moreMeet Whittock Consulting Ltd Director, James Comer

This month we’re shining the spotlight on Director James Comer. James joined Whittock Consulting Ltd 3 years ago and was recently promoted from Practice Manager to Director. He is our resident MTD and Xero Accounting expert and has helped make many of clients’ lives easier through helping to streamline their systems. What’s you...

Read moreThe Benefits of Terms & Conditions

Running your own business is tough. It demands time, energy and commitment, and inevitably there is always something else that needs to be done. As a business owner, you therefore have to prioritise, which can sometimes lead to a focus on service delivery with administrative tasks slipping down the to-do list for later. However, the...

Read moreThe Benefits of a Shareholder Agreement

Can you answer the following questions? a. Do you know what your internal company rules are in relation to a share sale? b. Do you have a mechanism to value your shares? c. In what circumstance can you force a shareholder to sell? d. Do you know what happens to shares if a shareholder dies? If the answer...

Read moreMeet our Apprentice Troy Groves

Meet our Apprentice, Troy Groves. Already a valued member of the team, Troy is contributing his growing expertise to benefit Whittock Consulting Ltd's clients while continuing to develop his career in finance. He recently passed his Level 2 AAT exam with flying colours and has now commenced his level 3 qualification. What’s your back...

Read moreCongratulations Troy Groves

At WCL, we see investing in our team as key to the success of the business and in developing our service offering. On this note, we are pleased to congratulate our Apprentice Troy Groves who has passed his latest Level 2 AAT exam with flying colours. Troy will now commence his level 3 qualification and we are delighted he can build his...

Read moreCustomer Success Story: Conversational AI

Established in 2020, Conversational AI Limited (“CAI”) provides specialist consulting services to Enterprises in Artificial Intelligence, helping them deploy intelligent solutions, such as chatbots, to automate customer interactions. Their services range from ideation and strategic planning through to solution design and build of chat...

Read moreThe Benefits of Management Accounts

When you are busy running your business, why then spend time preparing management accounts? How do they actually help your business? Is it time well spent when you could be running other areas of your business? Other than needing to produce statutory accounts, why then produce more financial information? Management accounts can help...

Read moreWelcome to the team Mackenzie Winbow

This month we welcome our new Senior Accounts Assistant, Mackenzie Winbow. Mackenzie is highly qualified and thrives on getting to know clients so he can find the perfect accounting solutions to suit their needs. What’s your background and what made you the perfect fit for Whittock Consulting? I grew up in Yate, so the South West...

Read moreOur Top 10 Contract Tips (Part 2)

We have continued to share our series of Top 10 Contract Tips on our social media channels over the summer. Here’s Part 2 of our Contract Tips blog with tips #6-10: #6 TURN YOUR CONTRACT INTO AN ASSET As well as protecting your business and managing risk, a contract can also be an asset. A well-defined contract pos...

Read moreShould my business have tax investigation insurance?

More than ever before, HM Revenue and Customs (HMRC) are cracking down on individuals and businesses who aren’t paying the right amount of tax. Investigations can be invasive, worrying, long and expensive. But you can avoid those sleepless nights and make sure you’re protected. Here’s what you need to know. What is a tax inves...

Read moreWhittock Consulting Ltd is awarded Xero Gold Partner status.

We are delighted to announce that Whittock Consulting Ltd have achieved Xero Gold Champion Partner status. With the additional training our team receive, we are now able to provide the highest level of service and value add to our clients. Whittock Consulting Ltd was set-up in 2013 with a view to supporting growing businesses with outs...

Read moreWhittock Consulting Limited acquires client base of TJS Business Solutions Limited

July 2021 Whittock Consulting Limited (WCL) are pleased to announce its successful acquisition of the accounting client base of TJS Business Solutions Ltd (TJS), allowing its current owner to focus on its coaching business. WCL, based in Warmley, Bristol, has seen significant organic growth over recent years and has now taken the pl...

Read moreOur Top 10 Contract Tips – Part 1

Over the past few weeks, we’ve been sharing our best contract tips via our social media channels. For most small businesses, employing an in-house legal counsel is not an option, but our outsourced business law service could be the perfect fit. If you’d like to follow our series of tips, you can follow us on Linkedin, Twitter or Fa...

Read moreHow Xero accounting software makes life easier for us and you

Whittock Consulting Ltd are proud of our Xero Certified Silver Partner status. As you’d expect, we use Xero a lot here, and in tandem, many of our clients do too. In this latest blog, we thought we’d share some of the benefits we deliver to our clients through our Xero partnership. What is Xero Accounting Software? Xero is a cloud-b...

Read moreSmall business pessimism highlights the need to take insight from your numbers.

According to a recent survey from ACCA UK (the Association of Chartered Certified Accountants) and The Corporate Finance Network, 1 in 5 small businesses believe full trading recovery following the COVID-19 pandemic will take two years. This gloomy prediction came from a survey of accountants representing 7,065 clients. The same articl...

Read morePost-lockdown Intel for Company Directors

Are you a company director seeking guidance as we exit lockdown? Want to know the potential pitfalls and opportunities that lie ahead? To help you chart the way, here’s our intel on 5 areas on which Company Directors need to be aware. 1. Dividends timebomb? If you’ve taken dividends this year, you need to be sure the busines...

Read moreCompanies House – a few changes

Companies House has issued guidance to its customers regarding accessing its services during the ongoing pandemic. Companies House is trying to make access easier utilising electronic means. As such it is encouraging us where possible to meet filing requirements via the online portal. Currently accounts, confirmation statements, certai...

Read moreHave referees blown the whistle on IR35 rulings?

When the English football season was paused due to Covid-19 you may have been missing your football fix. However, during this time a very important football match was being played out. The two teams? HMRC v Professional Game Match Officials Limited (PGMOL) or referees to you and I. What happened pre-match? Premier League referees are em...

Read moreGoodbye Job Retention Scheme, Hello Job Support Scheme

As of 31st October 2020, the Government’s current job retention scheme will cease. Currently employers can claim up to 70% of an employee’s wages who is on furlough subject to the salary cap. However, last week the Chancellor announced a further scheme aimed to continue to assist employers and prevent unnecessary redundancies. Wha...

Read moreFinance Director MOT

WCL is offering a new service to assist companies in understanding what their business finances look like as things start to slowly return to normality. Monitoring financial performance is key to any successful business. We are now offering a limited number of FD MOT’s to new customers in the run up to Christmas. The scope of work ...

Read moreWhat’s your Lockdown story?

At a recent networking event, I heard someone explain what their company did and didn’t do during lockdown. This started us thinking as to what we did and didn’t do at WCL over that period and we would like to share these with you. 3 things we did do: Called (rather than e-mailed) clients regularly to check on how they were ...

Read moreWhat does your business look like post Covid?

As lockdown restrictions ease and companies start to see an increase in business; now is the time to plan what the next few months and even years start to look like. Decisions made in the next few months could have far reaching consequences. The Coronavirus Business Interruption Loan Scheme (CBILS) and the Bounce Back Loan (BBL) have b...

Read moreTOP CONTRACT TIPS

#15 GET ADVICE Of course we would say that wouldn't we! Yes, but we are often met with the phrase "I wish I had spoken to you first". You don’t have to spend a fortune on advice. Whoever it is you want to engage with, that professional adviser's review of your contract can give you great peace of mind. They can: point out the...

Read moreTOP CONTRACT TIPS

#14 TURN YOUR CONTRACT INTO AN ASSET Think of the contract as a strategic tool to protect your business and manage risk. In our prior blog about negotiating contracts we set out key clauses to include. These are central to managing risk in your business. However, it can also be a positive asset as well. Why not use it is a marketing to...

Read moreTOP CONTRACT TIPS

#13 ALWAYS REVIEW, NEVER FORGET Following on from our post about understanding the contract, it is just as important to review contracts as well. They are not a one off; they should almost be thought of as fluid. Why? Even if you have a very detailed scope of work, clients tend to ask you to add services. Don’t be afraid to upd...

Read moreTOP CONTRACT TIPS

#12 IS MY CUSTOMER BOUND? How do you ensure your customer knows they are bound by your contract terms? It is frustrating when someone says they are not subject to the contract because they have never seen it. The first step is to send a copy of your contract to your customer or certainly tell them where to find them. If you email co...

Read moreTOP CONTRACT TIPS

#11 DO NON COMPETES REALLY WORK? Non-compete clauses (also known as restrictive covenants) are commonly found in employment contracts. They are also used in many other business relationships. They are designed to prohibit third parties from offering business to the marketplace in competition with you. Provided they are appropriate a...

Read moreNew National Minimum Wage and National Living Wage increases and what you need to do

The national minimum wage applies to anybody that has reached the school leaving age, with the national living wage applying to those aged 25 and over. The current rates along with the new rates are below: Year 25 and over 21 to 24 18 to 20 Under 18 Apprentice April 2019 (current rate) £8.21 £7.70 £6.15 £4.35 ...

Read moreTOP CONTRACT TIPS

#10 SHOULD I BE EXCLUSIVE? Exclusivity in a contract will mean you are the only supplier supplying that particular service or product to the customer. If you are the supplier, this is great. It means you know there will not be anyone else there to compete for the potential orders the client makes. Plus, it can create customer loyalt...

Read moreCoronavirus Business Interruption Loan Scheme – some top tips

Here at WCL clients have been asking for assistance with regard to their applications for the Government's Coronavirus Business Interruption Loan Scheme (CBILS). Here are a few pointers as to what we see banks needing ahead of granting a loan under the government’s CBILS: They will only lend to businesses that can pay the money ...

Read more