The countdown to be the next Prime Minister – and what it means for you

After the past few years it’s hard to imagine a time where politics haven’t formed such a prevalent part of our daily discussions. Whether it’s been Brexit, lockdowns, or recessions, there seems to have been no shortage in political headlines.

And over the next couple of weeks it’s only likely to intensify as the campaign to be the UK’s next Prime Minister moves towards its conclusion.

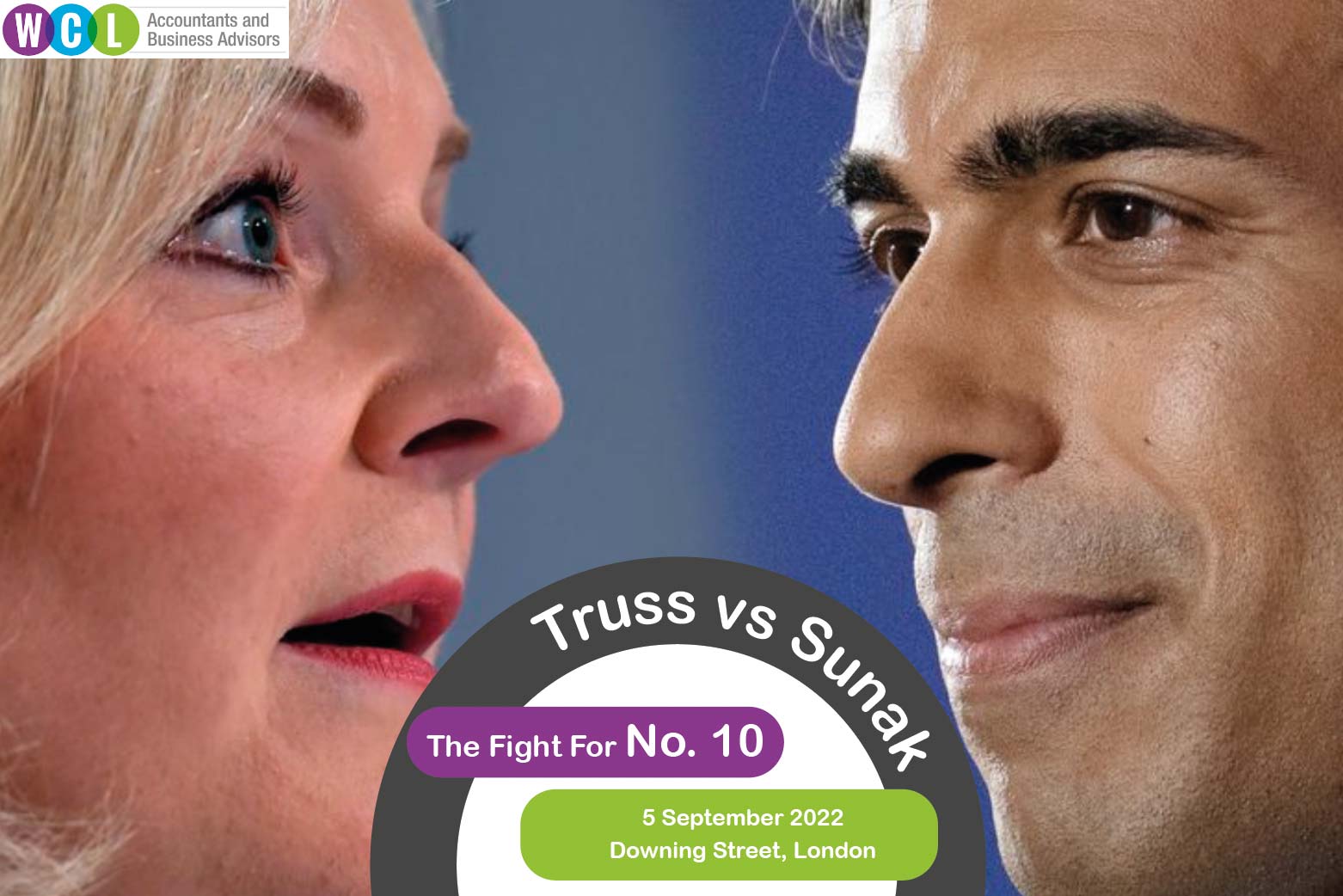

Following the resignation of Boris Johnson on 7th July, several of his peers quickly threw their names into the hat to be his successor. Now, having navigated their way through multiple rounds of voting and knock outs, we are down to the final two candidates: Rishi Sunak and Liz Truss. And on 5th September we’ll find out exactly who has won the race.

Whilst both candidates are part of the Conservative party, and thus will share a similar ethos in terms of goals and policies, their proposals for achieving said goals will differ. In this blog we discuss some of the plans they have used as part of their campaigns which might impact you. These proposals may change as their campaigns ramp up, so we recommend you keeping abreast of the latest news to understand how you might be impacted. Also, it’s important to note that we have only covered those points likely to sit under our remit as accountants/business advisors.

Main Priorities

Liz Truss has very much led with an immediate focus on cutting taxes. Rishi Sunak meanwhile has led his campaign talking about the pressing need to get inflation under control, with tax cuts to come later. As with anything, the devil is always in the detail…

National Insurance

Liz Truss has proposed reversing the recent rise in National Insurance, which came into effect in April.

Rishi Sunak hasn’t specifically discussed National Insurance as part of his campaign, but was responsible whilst chancellor for raising it by 1.25p in the pound to pay for health and social care. At the same time he also raised the earnings level at which it starts to be paid to £12,570. It is unlikely he would reverse his own proposals.

Corporation Tax

Liz Truss pledges to scrap a planned rise in corporation tax – currently set to increase from 19% to 25% in 2023.

Rishi Sunak, again, was responsible for delivering the above proposed increase whilst he was Chancellor, and plans to stick to his proposal. At the same time he has also mentioned reforming the system to reward companies that invest and avoid penalising small and medium-sized companies.

Income Tax

Liz Truss plans to reform the tax system to make it fairer, treating households as one single entity. She has also talked about suspending the “green levy” – part of your energy bill that pays for social and green projects.

Rishi Sunak has promised the biggest tax cut in 30 years, reducing the basic rate from 20% to 16% within 7 years. This would consist of a reduction of 1% in April 2024 and a further 3% by the end of the next Parliament.

VAT

There have been no specific policies put forward by Liz Truss.

Rishi Sunak pledges to scrap the 5% VAT rate on household energy for one year if the price cap on bills rises above £3,000 for the typical household.

Summary

According to the bookmakers, the odds on the next Prime Minister are showing Liz Truss as the clear favourite (as at 20th August). It’s easy to understand why, she is after all proposing immediate tax cuts, whereas Rishi Sunak is telling us we need to sort the issue of inflation before we can look at such perks. Liz Truss claims she can achieve her proposals by spreading the UK’s “covid debt” over a longer period. Rishi Sunak naturally counters that this means we’re just passing today’s problems onto future generations. Perhaps it would have been simpler if they had led with campaign slogans “buy now, pay later” versus “don’t buy what you can’t afford”.

Of course, the elephant in the room is always the fact that we’re talking politics and political campaigns here. It wouldn’t be unheard of to see policies change (or evolve) once the winner is in place. Whatever happens, we’ll know soon…