National Minimum Wage vs Living Wage: Key Differences Explained

You’re probably familiar with the terms minimum wage and living wage. But do you know what the differences are between them?

In this article we run through all the differences and what you might need to be aware of.

Understanding the Three Wage Types

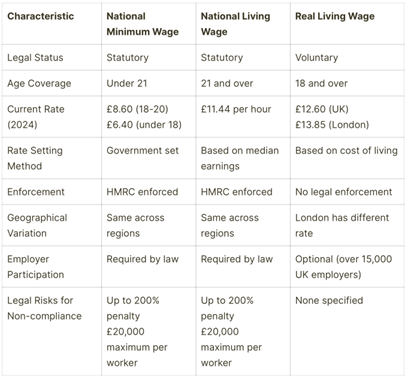

The UK has three different wage types that everyone should know about: the National Minimum Wage (NMW), the National Living Wage (NLW), and the Real Living Wage.

The National Minimum Wage protects workers under 21 years old. Workers aged 18-20 receive £8.60 per hour, while those under 18 earn £6.40 per hour.

The National Living Wage represents the highest statutory rate at £11.44 per hour for workers aged 21 and over. This marks one of the most important changes since April 2024, when it previously applied to those 23 and above.

The Real Living Wage differs because it reflects actual living costs. Employers can choose to implement this wage voluntarily, which currently stands at:

- £12.60 per hour across the UK

- £13.85 per hour in London

Each wage type has distinct characteristics:

Rates from April 2025

From 1st April 2025 the National Minimum Wage will be increasing as follows:

- Under 18 – £7.55 per hour

- 18 to 20 years old – £10.00 per hour

- 21 years and above – £12.21 per hour

Legal Requirements and Enforcement

The law doesn’t take wage compliance lightly, and strict enforcement measures are in place to protect employees. HM Revenue and Customs (HMRC) actively enforces these laws through regular checks to ensure proper wage payments.

HMRC can levy penalties up to 200% of the unpaid wages, with a maximum fine of £20,000 per worker. Employers can reduce these penalties by 50% if they pay all unpaid wages and half the penalty within 14 days.

Key Employer Obligations:

- Maintain accurate payment records for at least 6 years

- Pay any wage arrears immediately upon discovery

- Make records available for HMRC inspection at any time

If reported to HMRC and they find underpayment, they can:

- Issue a notice to pay money owed (up to 6 years back)

- Take legal action, including criminal proceedings

- Publicly name non-compliant employers

Employers who knowingly violate wage laws or falsify payment records face criminal charges. The government’s Labour Market Enforcement Orders can result in up to two years’ custodial sentence for serious violations.

Comparison Table

The table shows a side-by-side comparison of the differences:

Conclusion

Hopefully this article has helped to make clear the differences between the National Minimum Wage, the National Living Wage and the Real Living Wage.

It also highlights the requirements for employers and the strong legal rights that employees have. Companies that break these rules can face fines up to £20,000 for each worker, which shows the government’s steadfast dedication to fair wages.

If you would like more information, please get in touch. We’d love to hear from you.