Category: Employment Law

Staff vs Client Lunch: Your HMRC Tax Claims Explained

There’s no such thing as a free lunch. Well, there could be, but it depends on the details. Many business owners make the mistake of thinking all staff and client lunches can be recorded as an allowable expense claim with HMRC. Unfortunately, it’s not that simple. HMRC rules focus on whether your meal expenses serve "wholly and ...

Read moreInside or Outside IR35? Crack HMRC’s Rules with This Checklist

Over the past few years, IR35 has been a hot topic. The private sector underwent a major change in April 2021. Medium and large-sized businesses, not contractors, now determine IR35 status. This has created extra complexity. Recruitment agencies face this challenge more acutely, as they could receive hefty tax bills when end clients make ...

Read moreAccounting Mistakes That Cost Small Businesses Big

Small businesses can face devastating financial consequences from accounting mistakes that often go undetected until serious issues arise. These problems usually surface when tax bills arrive, deadlines pass, or funding applications need review. Poor cash flow management can get pricey and create tax complications. In extreme cases, it mi...

Read morePAYE Settlement Agreements Explained: Save Time and Money on Employee Benefits

Would you like to reduce your tax obligations whilst increasing benefits to your employees? If that appeals, then PAYE settlement agreements could be something of interest. PAYE settlement agreements let you make one annual payment to HMRC. This eliminates the need to process multiple employee benefits through payroll or P11D forms. Yo...

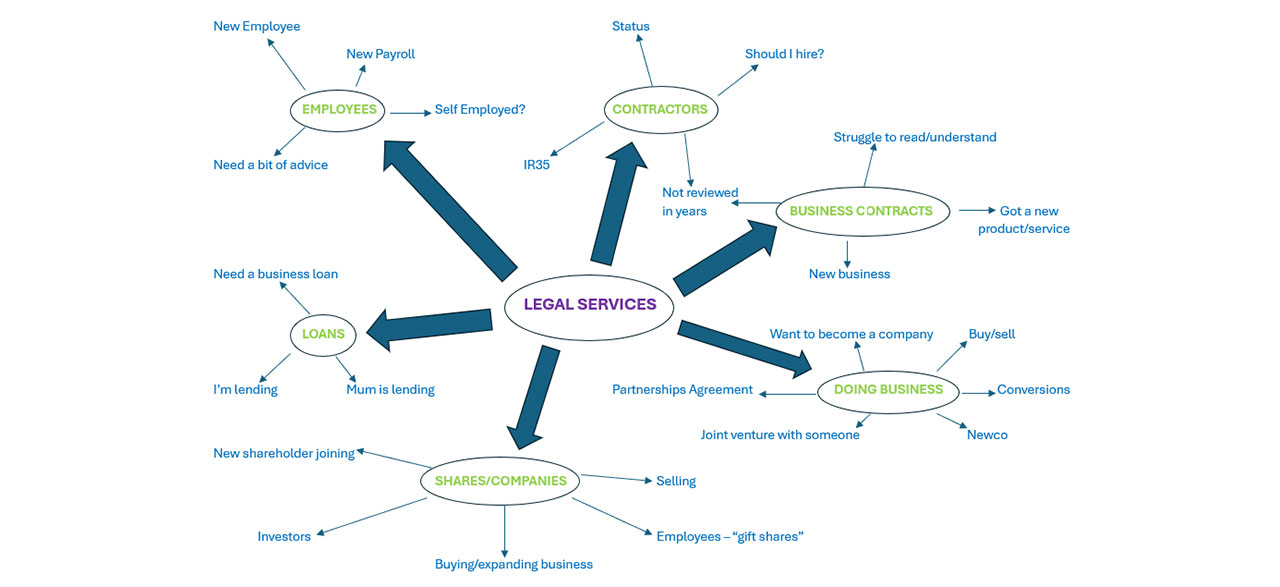

Read moreBusiness Legal Services: Essential Protection Your Company Shouldn’t Ignore

Your company needs proper business legal services to stay protected. Small startups and large enterprises alike face challenges in the legal world without expert guidance. People often think legal services are there to help manage crises, but good legal support should ensure you don’t find yourself in that position to start with. The...

Read moreEmployment Contracts

Written statements and Employment Contracts When a new employee starts a written statement of particulars of employment (Written Statement) must be provided to an employee. What must be included within the Written Statement? The Written Statement must contain the following information: Names of the employer and employee. The da...

Read moreUK Employment Rights Bill Sets New Rules for Businesses

The Employment Rights Bill (the Bill), published back in October 2024, brings one of the biggest changes to UK employment law in recent years with 28 reforms in multiple areas and is very near the end of its Parliamentary journey. Those in the “know”, suggest the Bill will receive Royal Assent in November 2025 with the first provisi...

Read moreContractor vs Employee: The Truth About Hiring Costs in 2025

The contractor vs employee decision can save your business thousands of pounds if you understand the true cost implications. The UK has 2.05 million freelancers in 2024, and businesses are thinking over their hiring options more than ever. Contractors might charge higher hourly rates than employees, but the complete financial picture isn'...

Read moreStatutory Payments – Neonatal Care Leave

Welcome to the third and final instalment of our statutory pay series. In part one we covered what statutory pay is, the minimum earning thresholds, and amounts etc. In part two we went through how to set up your payroll system and common pitfalls to avoid. And now, in this final part we will discuss some of the key points in handling req...

Read more2025/2026 Tax Rates and Allowances

The tax year runs from 6 April. Here’s an overview of the main tax rates, allowances and national Insurance contributions that you need to be aware of for the tax year starting 6 April 2025. If you have any questions, would like to understand what rates specifically apply to yourself, or what allowances are available, please get in t...

Read more