Category: Corporation Tax

Staff vs Client Lunch: Your HMRC Tax Claims Explained

There’s no such thing as a free lunch. Well, there could be, but it depends on the details. Many business owners make the mistake of thinking all staff and client lunches can be recorded as an allowable expense claim with HMRC. Unfortunately, it’s not that simple. HMRC rules focus on whether your meal expenses serve "wholly and ...

Read moreAccounting Mistakes That Cost Small Businesses Big

Small businesses can face devastating financial consequences from accounting mistakes that often go undetected until serious issues arise. These problems usually surface when tax bills arrive, deadlines pass, or funding applications need review. Poor cash flow management can get pricey and create tax complications. In extreme cases, it mi...

Read moreMaking Tax Digital

Making tax digital – current requirements All vat registered businesses with a taxable turnover above the vat threshold of £85,000 are now required to follow the mtd rules. This means: They must keep digital records They must make more frequent submissions (quarterly) They must use software to make submissions to hmrc e....

Read moreBudget 2025: Your Essential Guide to the Latest Tax Changes

Who had “budget leaked early” in the sweepstakes? Joking aside, that was probably the biggest news on the day, especially given all the negative headlines in the previous weeks. Given the financial position of the country, it was always going to be a question of how the government could increase income. For context, the UK governme...

Read moreHow to Change Accountant: A Stress-Free Guide for Business Owners

Switching accountants might seem daunting, but you don't need to wait until year-end to make the change. Your business or limited company can transition to WCL smoothly with minimal disruption. The switch makes sense when your current accountant fails to provide proactive advice or overlooks potential savings. The process works seamles...

Read moreContractor vs Employee: The Truth About Hiring Costs in 2025

The contractor vs employee decision can save your business thousands of pounds if you understand the true cost implications. The UK has 2.05 million freelancers in 2024, and businesses are thinking over their hiring options more than ever. Contractors might charge higher hourly rates than employees, but the complete financial picture isn'...

Read moreChanging from Sole Trader to Limited Company: Your Step-by-Step Blueprint

Are you running a sole trader business that's making £50,000 yearly profits? At the time your earnings hit this threshold, switching from sole trader to limited company status becomes a smart financial choice. Your growing business might make you think about changing to a limited company structure to save on taxes. In fact, the switch...

Read moreHow to Read a Balance Sheet: A Plain-English Guide for UK Business Owners

Reading your balance sheet isn't just good practice - it's crucial for any business owner. Your balance sheet shows what your business owns (assets) and owes (liabilities) at any given moment. This financial statement ranks among the most important documents that business leaders, regulators, and potential investors need to understand. ...

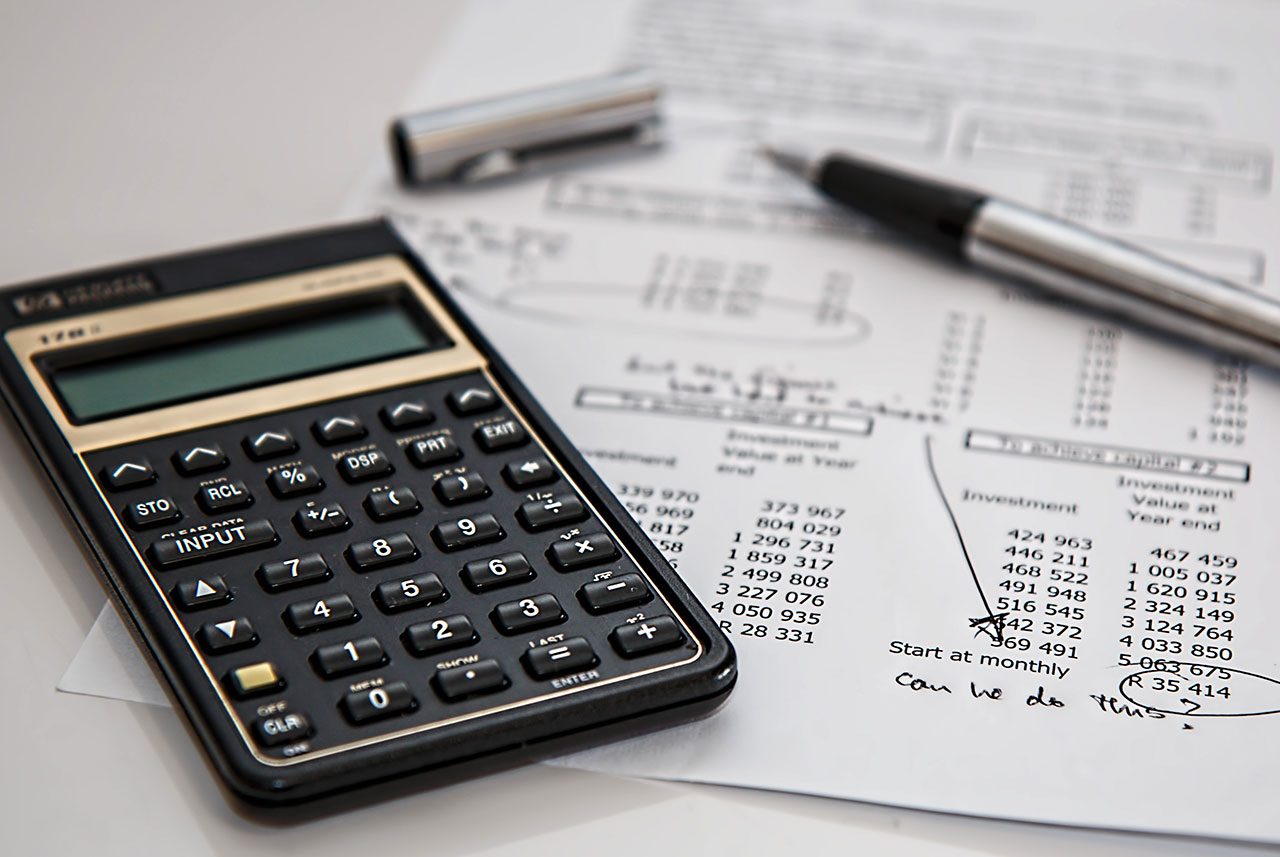

Read more2025/2026 Tax Rates and Allowances

The tax year runs from 6 April. Here’s an overview of the main tax rates, allowances and national Insurance contributions that you need to be aware of for the tax year starting 6 April 2025. If you have any questions, would like to understand what rates specifically apply to yourself, or what allowances are available, please get in t...

Read moreSpring Statement 2025

On Wednesday 26th March 2025, Chancellor Rachel Reeves delivered her Spring Statement. In terms of announcements for the average person, it was fairly low key with many of the announcements more aimed at a national level in terms of defence spending, overseas aid, etc. That said, there were of course still announcements to be aware of. An...

Read more