Go Back

Making Tax Digital

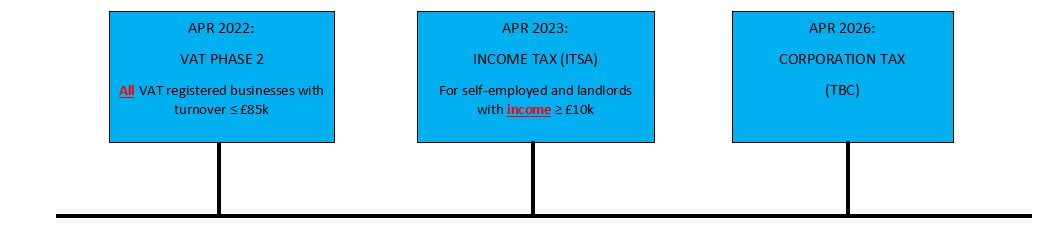

Making tax digital – current requirements

All vat registered businesses with a taxable turnover above the vat threshold of £85,000 are now required to follow the mtd rules.

This means:

- They must keep digital records

- They must make more frequent submissions (quarterly)

- They must use software to make submissions to hmrc e.G. Xero

- Main benefit of mtd – helping individuals and businesses to get their tax right

Next phase

Contact us on 01225 878685 or [email protected] to discuss your mtd requirements and understand what the future position may be.