Specialist areas

- Business Analysis

- Bookkeeping

- Cloud Accounting

- Statutory Reporting

- VAT Returns

Mackenzie is ACCA qualified with experience working in practice providing compliance services to clients. Mackenzie’s specialised areas include preparing year end statutory accounts and tax returns for sole traders, preparation of company accounts and corporation tax returns. He particularly enjoys answering client enquiries and finding solutions to those enquiries. Outside of work Mackenzie enjoys playing 5 aside football, running and supporting Bristol City FC.

What's one piece of accounting advice you think all business owners should follow?

Stay on top of your bookkeeping. When your records are up to date, you can spot issues early, make better decisions, and save time.

What's your role at the firm, and what does a typical day look like for you?

My role is a mix of supporting clients and managing the team. Most days, I’m reviewing or preparing accounts and management reports, helping staff with technical queries, and checking in with clients to keep things running smoothly.

What do you like to do outside of work?

Going to the gym, going on holiday in our campervan, spending time with friends. Supporting Bristol City.

What's one myth about accountants you'd like to bust?

That we just crunch numbers all day. There is loads of communication involved, we’re constantly talking to clients, helping solve problems, and working as a team.

If you could automate one part of accounting forever, what would it be and why?

Chasing client information, it takes up at lot of time and that time could be used on more valuable work for the clients.

If I wasn't an accountant, I would be...

Football manager of Bristol City.

"WCL has a unique offer. They have quickly become our trusted business partners for all things finance and legal. What a great asset to have. I'd highly recommend them."Manufacturing company owner

Latest news

PAYE Settlement Agreements Explained: Save Time and Money on Employee Benefits

Would you like to reduce your tax obligations whilst increasing benefits to your employees? If that appeals, then PAYE settlement agreements could be something of interest. PAYE settlement agreements let you make one annual payment to HMRC. This eliminates the need to process multiple employee benefits through payroll or P11D forms. Your agreement with HMRC […]

Read more

Contract Law UK: Your Informal Communications Could Be Legally Binding

Are you aware your casual WhatsApp messages and emails might create legally binding agreements? Did you know that UK contract law allows informal communications to establish enforceable contracts. In fact, the Court of Appeal showed this in a notable case. A binding contract emerged from email exchanges, WhatsApp messages, and phone calls between DAZN (a […]

Read more

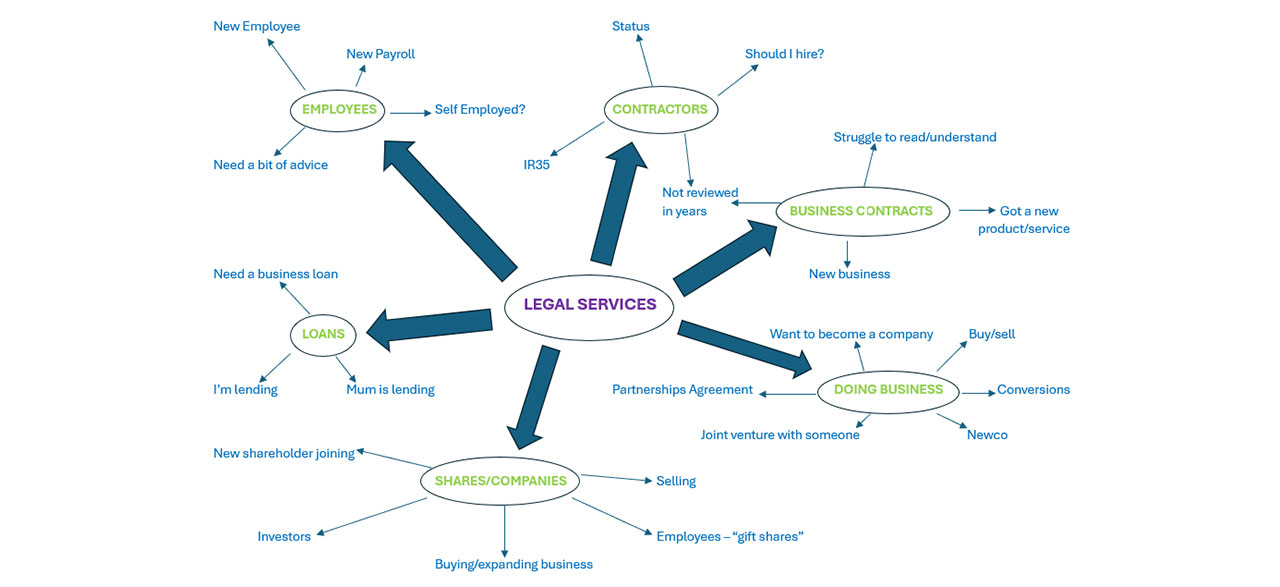

Business Legal Services: Essential Protection Your Company Shouldn’t Ignore

Your company needs proper business legal services to stay protected. Small startups and large enterprises alike face challenges in the legal world without expert guidance. People often think legal services are there to help manage crises, but good legal support should ensure you don’t find yourself in that position to start with. The right legal […]

Read more