Specialist areas

- Finance director

- Business strategy

- Financial planning

- Cash flow reviews

- Acquisitions

- Raising finance

Brad is an experienced Finance Director who is now enjoying using his skills to help his portfolio of clients. Having qualified as a Chartered Management Accountant in 2000, after completing a Law Degree, he held various senior roles in a variety of different industries.

After starting his career in management consulting in 1996, he has returned to this arena, specialising in financial planning and reporting. He has the ability to forge strong relationships with clients and is of the opinion that business should be fun.

Brad is a keen golfer, he played County golf for over 15 years as well as winning numerous regional championships.

What's one piece of accounting advice you think all business owners should follow?

Understand your balance sheet, not just your P&L.

What's your role at the firm, and what does a typical day look like for you?

I established WCL in 2013. Originally was only going to be me(!) but now we run a traditional accountancy firm covering bookkeeping, VAT, payroll, management accounts, Tax and Year End Accounts. Days are very varied, advising clients from start ups right up to £25m turnover groups.

What do you like to do outside of work?

Golf. Both playing and administration.

What's one myth about accountants you'd like to bust?

That we don’t have a sense of humour.

If I wasn't an accountant, I would be...

a Golf coach.

"Brad was our part time FD who helped us to realise our dreams of growing our business to heights we could only imagine. When we started working with Brad we were blind as to how our business was performing. Just three years later we sold the business to our largest competitor and are now part of a 550 person £120m business. This would not have been possible without Whittock Consulting! "Jason Cross, Director Synetiq

Latest news

PAYE Settlement Agreements Explained: Save Time and Money on Employee Benefits

Would you like to reduce your tax obligations whilst increasing benefits to your employees? If that appeals, then PAYE settlement agreements could be something of interest. PAYE settlement agreements let you make one annual payment to HMRC. This eliminates the need to process multiple employee benefits through payroll or P11D forms. Your agreement with HMRC […]

Read more

Contract Law UK: Your Informal Communications Could Be Legally Binding

Are you aware your casual WhatsApp messages and emails might create legally binding agreements? Did you know that UK contract law allows informal communications to establish enforceable contracts. In fact, the Court of Appeal showed this in a notable case. A binding contract emerged from email exchanges, WhatsApp messages, and phone calls between DAZN (a […]

Read more

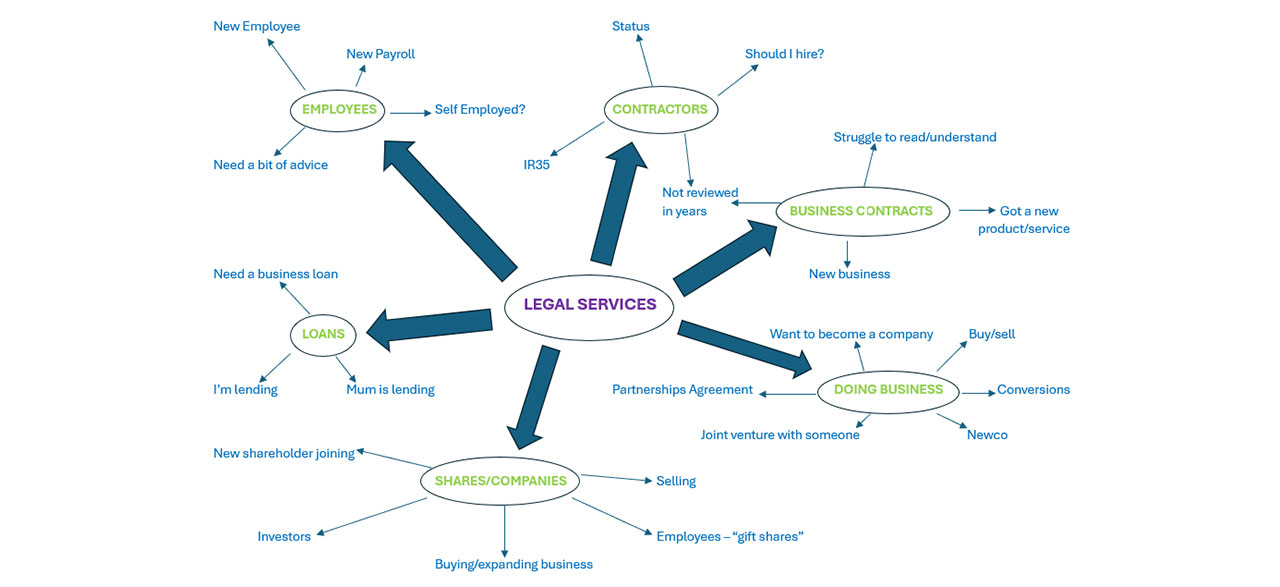

Business Legal Services: Essential Protection Your Company Shouldn’t Ignore

Your company needs proper business legal services to stay protected. Small startups and large enterprises alike face challenges in the legal world without expert guidance. People often think legal services are there to help manage crises, but good legal support should ensure you don’t find yourself in that position to start with. The right legal […]

Read more